The Definition of Pac-Man

The Definition of Pac-Man is a hostile takeover defense tactic in which a target firm tries to acquire control over the company that bid for it. Sometimes all the government forms that need to be filed can feel like a hostile takeover of your business and it can be overwhelming and stressful. We work hard to avoid that Pac-Man stress for our clients.

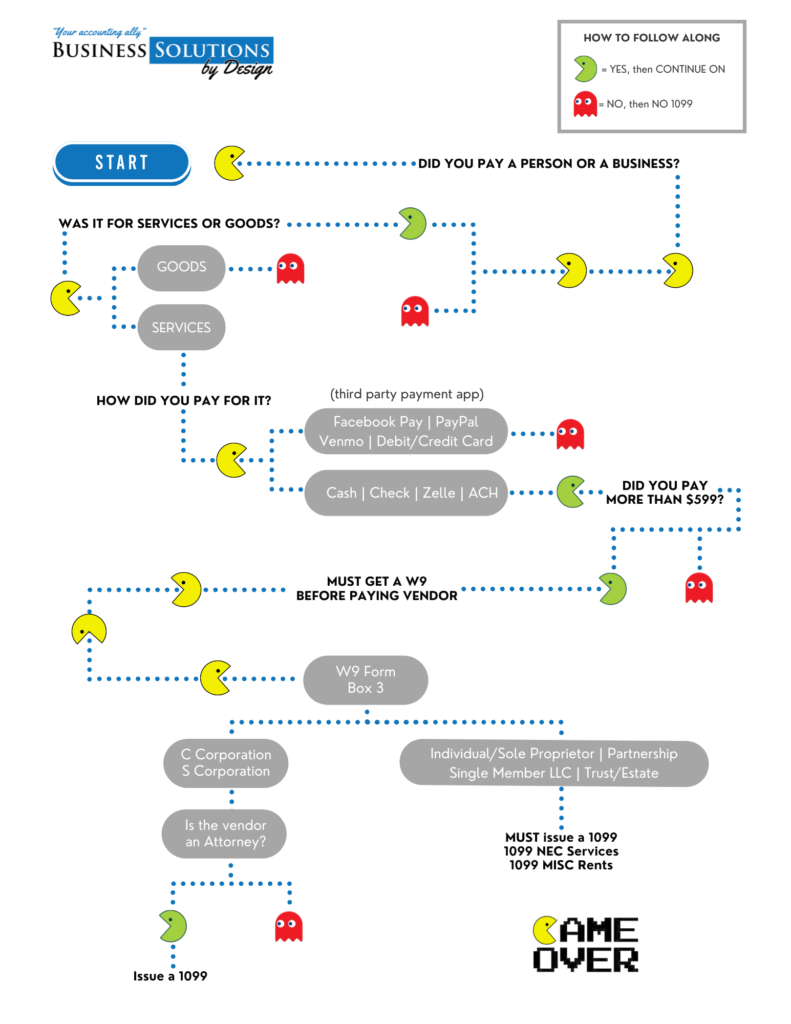

We have recently had numerous questions about filing a 1099 Form.

Who Has to File A 1099 Form? Businesses are required to issue a 1099 form to a taxpayer (other than a corporation) who has received at least $600 or more in non-employment income during the tax year. For example, a taxpayer might receive a 1099 form if they received dividends, which are cash payments paid to investors for owning a company’s stock.

Do I Have to Pay Taxes on a 1099 Form? Typically, income that has been reported on a 1099 is taxable. But there are exceptions and offsets that reduce taxable income.

Who Needs to Get a 1099 Form? Usually, anyone who was paid $600 or more in non-employment income should receive a 1099.

Do I Need a 1099 Form to File Taxes? Taxpayers are required to report any income even if they did not receive their 1099 form. However, taxpayers do not need to send the 1099 form to the IRS when they file their taxes.

What Is the Difference Between a 1099 and a W2? A 1099 form shows non-employment income, such as income earned by freelancers and independent contractors. On the other hand, a W2 shows the annual wages or employment income that a taxpayer earned from a particular employer during the tax year. Unlike a 1099, a W-2 shows the taxes withheld by the employer from the employee’s salary throughout the year.

Basically, A 1099 form is used to report non-employment income, including dividends paid from owning a stock or income that you earned as an independent contractor. There are a variety of 1099 forms since there are many types of income, including interest income, local tax refunds, and retirement account payouts.

Confused Yet? We hope not but if you want our help, we are here with solutions for your business. adavis@businesssolutionsbydesign.com